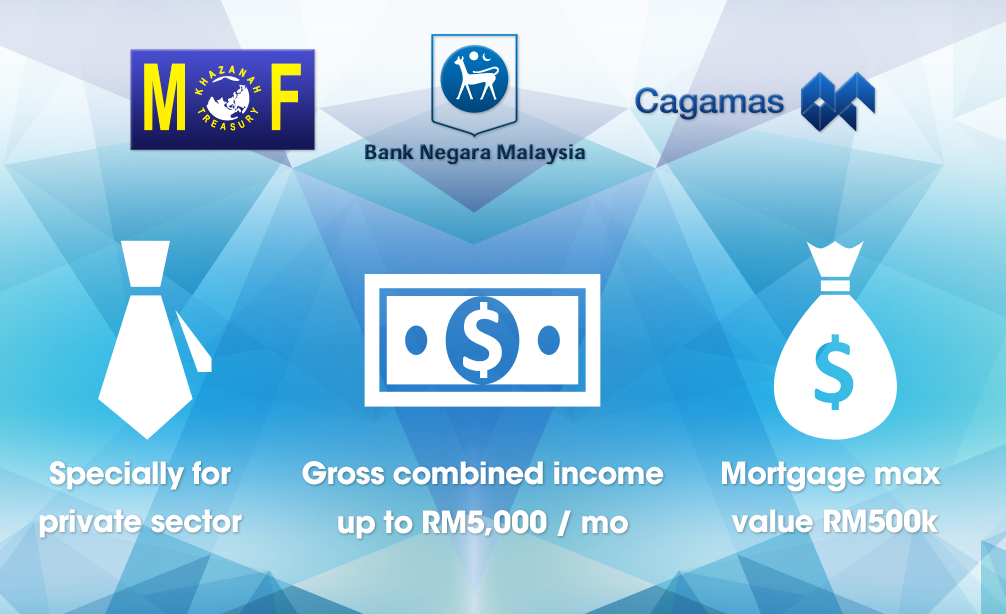

Skim Rumah Pertamaku (SRP) - My First Home Scheme

Skim Rumah Pertamaku (SRP) - My First Home Scheme was first announced in the 2011 Budget by the Malaysian Government to assist young adults who have just joined the workforce and earning not more than RM5,000 per month to own their first home.

The Scheme allows young adults to obtain 100% financing from financial institutions, enabling them to own their 1st home without the need to pay a 10% downpayment.

Key features and Benefits

First Home purchase (Subject to affordability)

- Up to 100% financing

- Residential property only

- Available in both conventional and Islamic

- Must be a Malaysian citizen

- First time home-buyer

- Individuals up to age 40 years

- Employees in private sectors, including statutory bodies that do not offer government staff housing loan/financing facility

- Single applicant gross income not exceeding RM5,000/month and joint applicants gross income not exceeding RM10,000/month (based on gross maximum income of RM5,000/month per applicant)

- Repayment of total financing obligation must not be more than 60% of the net monthly income or maximum financing limit of the participating bank, whichever is lower

- Financing tenure not exceeding 35 years, subject to applicant’s age not exceeding 65 years at the end of financing tenure. Revised maximum tenure is in line with BNM’s ruling announced on 5 July 2013.

- Amortising facility only (no redrawable features)

- Instalments payable via monthly salary deduction or standing instruction

- Compulsory Fire insurance/takaful

- Residential properties located in Malaysia

- Minimum property value of RM100,000

- Maximum property value of RM500,000

- Owner occupied (buyers are required to reside in the property)

Participating Banks (Conventional & Islamic banking)

1. AffinBank

2. AmIslamic Bank

3. CIMB Islamic

4. Alliance Bank

5. Bank Islam

6. Hong Leong

7. Alliance Islamic Bank

8. AmBank

9. Bank Muamalat

10. CIMB Bank

11. Hong Leong Islamic Bank

12. Maybank

13. Maybank Islamic

14. OCBC Bank

15. OCBC Al-Amin

16. Public Bank

17. Public Islamic Bank Berhad

18. RHB

19. RHB Islamic Bank

20. Standard Chartered

21. Standard Chartered Saadiq

22. UOB

For more information, check out http://www.srp.com.my/en/index.html

Source: http://www.srp.com.my/en/index.html